Property Making an investment - A Rewarding Way to Diversify Your Investment Stock portfolio

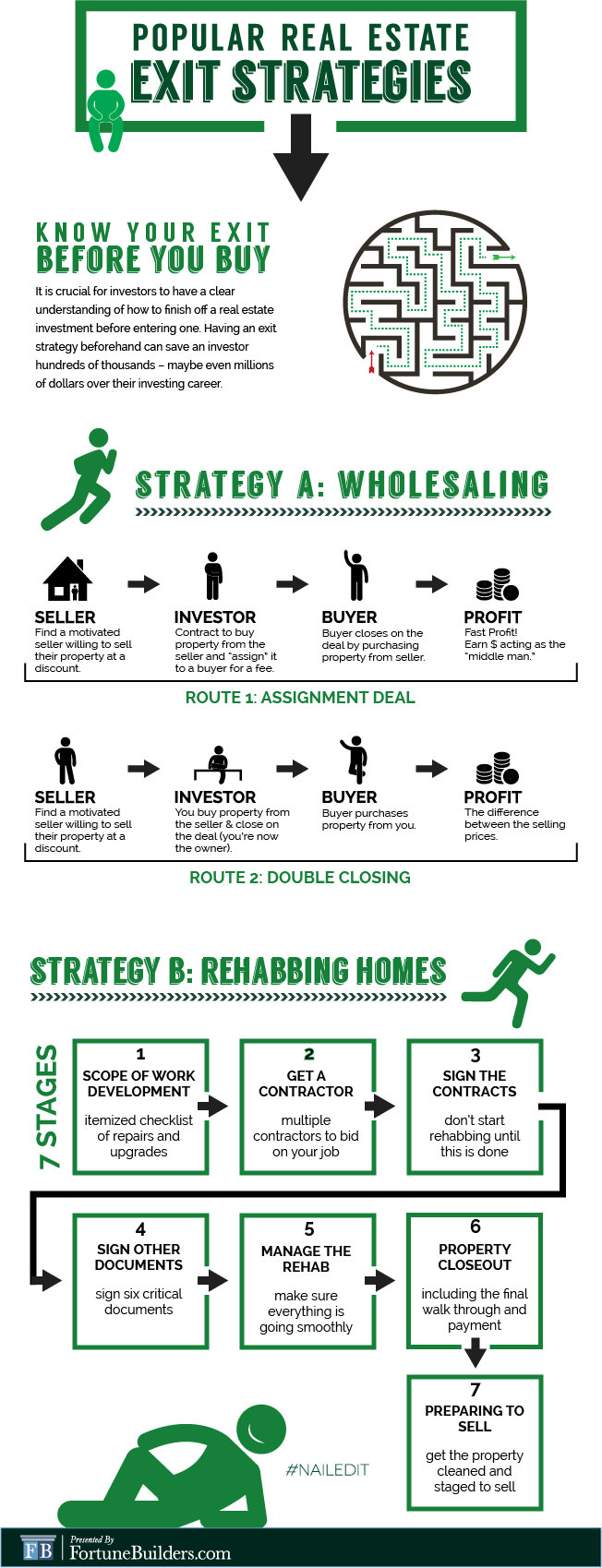

Real estate property shelling out is surely an excellent strategy to diversify your investment portfolio. But be cautious when deciding on the correct house. Productive real-estate traders often employ a variety of strategies, including wholesaling and trade-up strategies additionally they may acquire REITs, comparable to common money.

Real-estate assets supply excellent taxation and revenue benefits, assisting to minimize simple-term market fluctuations although developing long term wealth development.

Location

Real-estate committing is usually one of one of the most profitable methods for earning passive income. Hire monthly payments from tenants supply a steady source of earnings that can deal with home expenses or nutritional supplement an investor's existing earnings stream. However, nonetheless, getting a great spot for your leasing home can be challenging: its desirability affects lease costs and can raise returns significantly.

Real-estate assets offer you buyers several taxes advantages, which include depreciation and house loan curiosity reductions. Furthermore, investing in real-estate offers diversification in a investor's portfolio, which lowers danger in the down market place. Investors that do not want to grow to be immediate property owners may opt for REITs that invest in real estate property belongings when spending benefits back out to traders.

Essentially, when picking the perfect area for your hire residence, always keep its expansion possible and nearness to employment locations, shopping, and enjoyment places in your mind. General public transit methods with exceptional providers will entice prospective residents facilities close by might help entice a greater swimming pool of renters and improve cashflow.

Spot can in addition have a main impact on a lease property's long-term value, specifically in central cities where new homes may be minimal, developing shortages in property offer and traveling up need for leasing properties because location. When buying central metropolitan areas, pay attention to their long term growth wants to stay away from generating faults with the expense choices.

If you're a novice to real estate making an investment, working together with a highly skilled representative is tremendously recommended. These pros will allow you to navigate the neighborhood housing market and identify purchases with higher returns on the purchase. SmartVestor offers a free support which fits you up with up to five investing professionals in your town - you could find one through here too!

Real estate investments need finding an ideal spot that could create higher leasing profits although attractive to a diverse group of residents. Mashvisor will help to help locate these kinds of places.

Residence kind

Property assets range from purchasing someone house to making an investment in large manufacturing properties, each of which offers their own list of dangers and rewards. You need to take your measure of engagement, risk patience, and profitability into mind to pick the most appropriate property kind for your self. Home alternatives might include single-loved ones residences, multi-device components (like apartments or condos), cellular house areas or natural property ventures that keep undeveloped but may produce greater revenue than recognized attributes.

Another choice for committing is purchasing residence to rent. Whilst handling tenants and having to pay income taxes on rental earnings requires much more job, this particular type of expenditure offers better results than other styles of shelling out and fewer unpredictability in comparison with conventional ventures. Moreover, working expenditures may even be deducted on your own tax statements!

Professional components, that are non-non commercial real-estate investments, like lodges, manufacturing facilities and workplaces are an ideal means for buyers to earn continuous income moves while admiring residence ideals after a while. Moreover, these business investments often expertise less economical imbalances and offer buyers peace of mind during financial downturns.

Real Estate Property Expenditure Trusts (REITs), open public firms that own a number of commercial and residential properties, can also help you commit ultimately. By buying offers in REITs you are able to make use of indirect shelling out while still entering real estate planet as they're an easy way to get started property making an investment without every one of the inconvenience that comes with selling specific qualities immediately.

Along with residential and commercial property assets, you might make raw territory an efficient tool school to buy. Unprocessed terrain typically lies in places with fantastic progress prospective and may lead to a lucrative profit if discovered correctly. In addition, undeveloped property may regularly be found for affordable prices. Prior to your own preference on an undeveloped plan of property even so, take care to consider all suitable zoning laws and regulations along with possible costs involved with establishing it including operating electric powered, normal water, and sewer lines on the website that could show costly when thinking about constructing properties on uncooked terrain or making an investment in it in raw territory - before undertaking something it could appear sensible to suit your needs before plunging directly in go first!

Credit

When making an investment in real-estate, there are many loans alternatives available to you. This can include typical personal loans, personal cash personal loans and self-aimed individual retirement life credit accounts (SDIRAs) devoted to real-estate purchase. Which loans approach suits you depends on your goals and experience level and also if it is possible to effectively control the home your self everyday managing smart. Finally, make sure you see how very much money is willing to be set towards this sort of endeavor.

Real estate assets provide an best strategy to both generate passive income and see long-term funds respect. There are numerous attributes you may put money into - non commercial, commercial and business. Some individuals purchase single homes to build leasing revenue while others opt for buying and reselling houses as ventures yet others spend money on redesigned residences to become distributed upon wholesaling homes completion.

Real estate property traders in today's market deal with increasing competitors wholesaling and higher interest rates, necessitating better familiarity with the market by and large and having the capacity to determine potential prospects and dangers. To thrive in today's real-estate marketplace, it is crucial that property traders possess this sort of knowledge.

To reach your goals in actual real estate investing, you have to have both the proper state of mind and staff into position. Be prepared for unexpected expenses like upkeep costs or openings last but not least, generally have a backup prepare completely ready if your market place transforms against you.

Financing your premises making use of bank lending options or mortgages, but there are additional alternatives like purchasing real estate property purchase trusts (REITs). REITs very own and deal with property components when having to pay out dividends to their shareholders - supplying another source of income.

An increasingly preferred method of financing property is crowdfunding programs, which connect developers and investors through providing debts or home equity ventures at an decided upon charge. When these purchases may be more dangerous and illiquid than classical strategies, they could provide diversification benefits in your portfolio.

Real-estate investment resources supply another risk-free way of purchasing attributes this expenditure motor vehicle swimming pools together several investors' funds to buy multiple components simultaneously, supplying you with usage of more qualities whilst getting passive income than making an investment straight in a single property.

Maintenance

Real estate expenditure is definitely an attractive selection for those seeking passive income. Real-estate offers various tax and diversity pros even so, buyers should be mindful associated with a servicing costs which could influence all round earnings on expense additionally, lease attributes need significant energy and time purchases.

In the core of each and every expense is preserving good conditions in a property. Doing so can increase its worth and bring renters in, decrease openings, minimize functioning costs and ensure normal examinations take place as an element of a upkeep program.

Real-estate can be physically examined to aid buyers examine its quality and determine its suitability for an purchase opportunity. Furthermore, this evaluation can establish any structural problems or another worries that may minimize house beliefs.

Real estate making an investment gives numerous specific benefits, such as taxation deductibility for house loan interest payments, home fees and repairs expenditures. This could drastically reduced tax obligations although simultaneously growing returns. In addition, assets typically provide higher cash moves - a beautiful characteristic to any investor.

Real estate committing requires important upfront capital and will be inelastic as a result, it could take much more time for profits on expense into the future through additionally, locating renters during financial downturns may show difficult.

Diversifying a genuine estate portfolio is also very important, shielding investors against market changes and reducing the potential risk of burning off cash. Doing this requires diversifying across various property varieties, trading markets and geographies - as an illustration purchasing both commercial and residential attributes improves one's likelihood of building a revenue.,